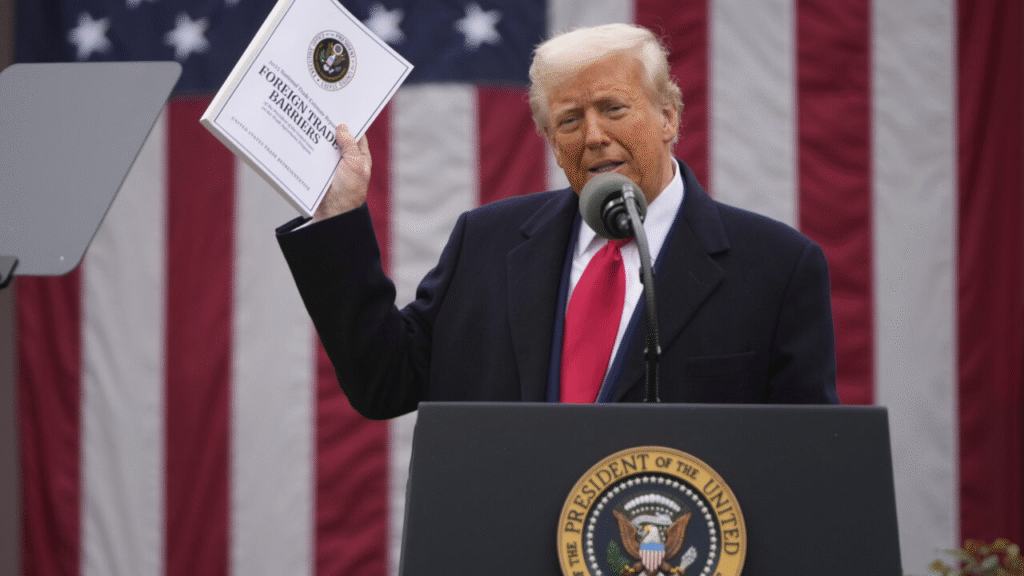

Trump Tariffs and Their Global Trade Impact

By Prabha Gupta August 27, 2025

When U.S. President Donald Trump imposed steep tariffs, the effects spread across continents. The decision was not just about American factories. From Asia to Europe, trade partners are revising their strategies. Businesses that once relied on smooth global supply chains now face fresh uncertainty. Economists say the tariffs signal a deeper change in U.S. trade policy. Protectionism is slowly replacing the free-market consensus that guided world trade for decades.

The textile industry, often called the backbone of Asian exports, is facing one of the toughest blows. India, Bangladesh, and Vietnam depend heavily on U.S. orders for growth. Now, every new deal carries risk. Exporters are unsure if shipments will clear smoothly or be delayed at ports. The uncertainty is forcing many firms to cut production and scale back investment. Globalization, once hailed as unstoppable, suddenly appears fragile and contested.

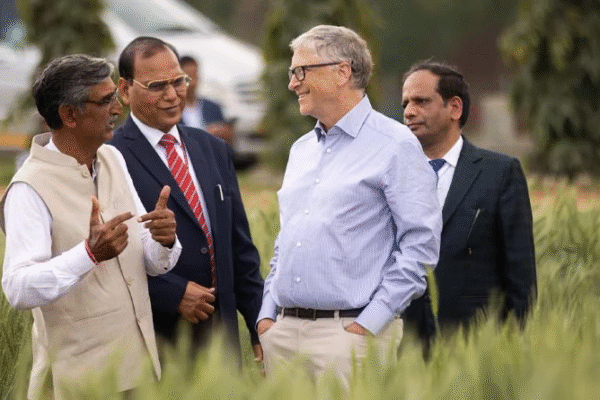

India Feels the Shock

India’s garment hubs are among the hardest hit. Production lines in Tirupur, Noida, and Surat have slowed. Exporters report that U.S. buyers are either postponing shipments or canceling them outright. The impact is severe for workers, many of whom depend on daily wages. Thousands now fear unemployment as factories cut costs and reduce shifts.

Exporters argue that without government support, India risks losing long-term contracts. They also warn that competitors like Vietnam could capture U.S. market share. Trump Tariffs Deal a Blow to India’s Textile Hub explains in detail how factories in Tirupur, Noida, and Surat are struggling to survive. Read more about how Trump’s tariffs Deal A Blow to India’s textile hub. https://newshashtag.com/trump-tariffs-hit-textile-industry-surat-noida-job-crisis/s://newshashtag.com/trump-tariffs-hit-textile-industry-surat-noida-job-crisis/

Vietnam and Bangladesh Seek Openings

In contrast, Vietnam sees a possible opening. Exporters there are pitching themselves as reliable partners to U.S. brands seeking alternatives to China and India. They highlight stable policies and improving infrastructure. However, challenges remain. Raw material costs are high, and logistics bottlenecks add delays. Gains are possible, but the opportunity may not be enough to offset global turbulence.

Bangladesh is also trying to secure new contracts. The country already has a strong textile base and low wages. Yet, it struggles with outdated infrastructure. Power shortages, port delays, and weak transport systems restrict expansion. Buyers remain cautious despite attractive prices. As a result, Bangladesh’s capacity to absorb major U.S. orders remains uncertain.

Meanwhile, European retailers worry about rising costs. Fast-fashion chains that depend on Asian imports may pass expenses on to consumers. If demand shrinks, both retailers and suppliers could face deeper losses. China, still the world’s largest exporter, is redirecting trade. It is building stronger ties with Africa, Latin America, and Southeast Asia to reduce dependence on the U.S. market.

A global turning point is unfolding. One American policy decision has reshaped trade flows across continents. Economists believe regional trade blocs may grow stronger. Others warn of recession-like shocks in emerging economies. But one fact is clear. Global trade will not return to its old form. Trump’s tariffs have set a lasting transformation in motion.

Prabha Gupta is a veteran journalist and civic thinker dedicated to the constitutional ideals of dignity and institutional ethics. With over thirty years of experience in public communication, her work serves as a bridge between India’s civil society and its democratic institutions. She is a prominent voice on the evolution of Indian citizenship, advocating for a national discourse rooted in integrity and the empowerment of the common citizen